| EBS Description | Translates to AR in Cloud |

|---|---|

| Business Group | Enterprise |

| Operating Unit | Business Unit |

| Accounting Rules | Revenue Schedules |

| Finance Charge | Late Charge |

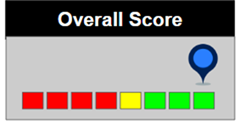

| Criterion | Cloud Improvement Score | Cloud Applications (Release 13 - 22A) | EBS Applications (Release 12.1.x & above) | Cloud Improvement Metrics | Rationale for score |

|---|---|---|---|---|---|

| Functionalities : Gaining efficiencies by having efficient business processes supported by Cloud | |||||

| Processing payments received from customer using Smart Receipts |  |

Process to automatically match Receipts based on match recommendation score derived from matching rule weights | No Smart Receipt feature in EBS, only simple lockbox was available |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Extended functionality to match Receipts to Invoices automatically reducing manual matching |

| Revenue Recognition Compliance |  |

Centralized and automated revenue management to address revenue as per ASC 606 and IFRS 15 accounting standard with ability to recognize revenue independent of billing | Revenue recognition is dependent on invoicing |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Significantly reduces manual adjustments and potentially eliminates complex extensions/ workarounds |

| Enhanced Auto Accounting for Bills Receivables |  |

Flexibility to derive accounts based on auto accounting rules for Factored (Brokered), Remitted and Unpaid bills receivable | Only one option for Bills receivable to derive accounting is available in EBS |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Eliminates manual adjustments and potentially avoid complex extensions/ workarounds |

| Transaction Delivery |  |

Send printed documents using customer email options | No standard functionality available in application |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Potential for change to existing process without impacting efficiency |

| Credit Memo and Adjustment Approval |  |

Interface to configure complex approval rules using Approval Management Extensions (AMX) | Only simple approval rules can be configured in the application |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Significant improvement in compliance and higher degree of digitization |

| Automation of Joint Venture Credit Memo |  |

Through integration with Joint Venture cloud management, with the new transaction type 'JV Credit Memo', process for credit memo is automated | Integration with Joint Venture cloud management does not exist |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Integration with automation provides improved processing of credit memo, traceability and control for Joint Venture organizations |

| Revenue Impact for Credit Memo |  |

Revenue reversal is done using last date of earliest open period instead of system date for accounting of revenue reversal, creating accounting as close to the original transaction for improved revenue reporting | This functionality is not available |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Avoid manual adjustments earlier required for correct revenue reporting |

| Application of Unidentified Receipts from the Review Receipt Page |  |

Can now use Add Open Receivables button to derive customer information for an unidentified receipt | Functionality was available by navigating to multiple screens |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Brings about improvement in receipt application of unidentified receipts |

| Cash Pooling for Multifund Accounting |  |

Ability to perform cash pooling and generate appropriate accounting | Limited functionality |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Manual transaction/ accounting entries for cash pooling can be eliminated |

| Lockbox Receipt Matching |  |

Provides ability to add structured payment for receipts created through lockbox as reference for automatic bank statement reconciliation | This functionality is not available |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Significantly reduces number of manual matching of receipt transactions |

| Party Tax Profile |  |

All tax setup including tax profiles for customer/ customer site is centralized under Oracle Tax where common pofiles can be used across site with similar tax treatment | Party tax profile is maintianed under Receiavbles mapping to Cusomer/ Customer site |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Fewer tax profiles increase efficiency, reusability improves compliance |

| Receivables to General Ledger Reconciliation |  |

Provides details with ability to drill down, enabling easy reconciliation between Receivables and General Ledger | No drilldown is available |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Efficient reconciliation process ensures timely close of books |

| Shared Services |  |

Processing payments received from customers centrally for multiple business units operating under shared services model | Required switching between operating units even with MOAC |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Opportunity to use shared services. For organizations already using shared services, brings efficiency and reduces costs |

| Review Customer Account Details or Balances |  |

One screen to review customer transaction activities and balances across multiple business units | Required switching between operating units even with MOAC |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Improved business decisions with better visibility |

| Migrations/ Conversion/ Intengation : Quick and reliable path to cloud | |||||

| Open Transactions and Receipts Conversions |  |

MS Excel based templates (File Based Data Import) have been provided | Standard forms to key in the text manually or going thru extensions |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Faster migration to cloud with simplified conversion/ integration process |

| Bank Data for Lockbox |  |

||||

| Customer Conversions |  |

||||

| Reporting and Analytics : Easy, advanced visualizations | |||||

| Reporting |  |

Highly flexible reporting providing excellent data visualization are available using Oracle Transactional Business Intelligence (OTBI) | Limited standard reports availability and requires development of custom reports |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Easier for users to build reports accommodating diverse business requirements |

| Receivables Dashboard |  |

User interactive dashboards and work areas for billing, receipts and revenue with recommended daily actions and access to perform transactions can be easily configured | No standard dashboard available in application |

Improves Efficiency Process Improvement Improves Data Integrity Eliminates Extension/ Workarounds Improves Compliance |

Provides multiple Infolets with high level of data flexibility, actions performed, pending actions, notifications, graphs and possibility of minimal errors with data control compliance |

SCM Cloud vs Oracle Manufacturing

SCM Cloud Cost Accounting vs Oracle EBS Costing

Oracle Cloud General Ledger vs Oracle EBS General Ledger

Oracle Supply Chain Planning Cloud vs Advanced Supply Chain Planning

Procurement Cloud vs EBS Procurement

Oracle Order Management Cloud vs EBS Order Management

Oracle Inventory Management Cloud vs EBS Inventory

Oracle Product Data Management Cloud vs EBS Item Master

Oracle WMS Cloud vs R12 EBS WMS

Oracle Cloud PPM vs EBS Projects

Back to Comparison Summary - Oracle ERP Cloud (Fusion) vs Oracle EBS

Call 866-531-9587 / Write to info@triniti.com / Fill out the contact form.